I am in a taxi (the one that is supposed to seat 14 passengers as inscribed on the body but always carries more. smh!) headed back home after close to four hours of listening to Grace Makoko during the GROW program, @civsourceafrica mentorship and coaching program for leaders.

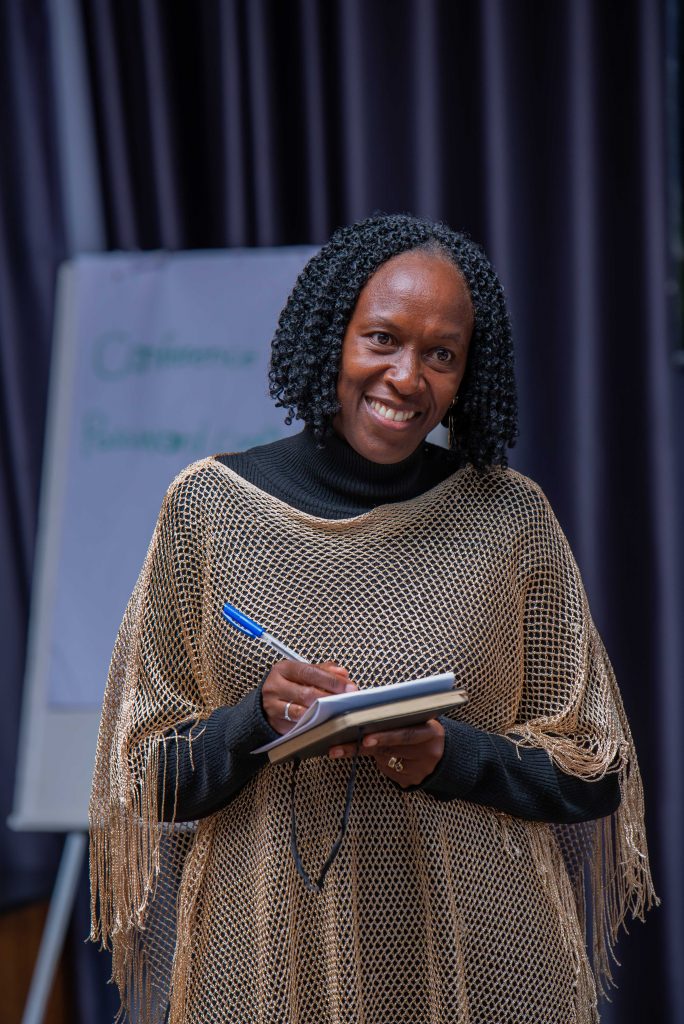

Grace is a career banker with over twenty-five years’ experience in the banking industry in East Africa. She is passionate about personal finance and wealth creation. Grace contributed a weekly column “Ask the Expert” on Personal Finance, Wealth Creation and Business in the New Vision, one of the nation`s leading weekend publications from September 2016 to October 2020.

Grace started her session with a personal story of how her family fell from grace with the regime transition-Obote to Museveni. Imagine knowing so much wealth that your back-to-school shopping is done in Paris, France!! When you’re sick, you are taken to the UK for treatment. You are wealthy and you have access. But in a twinkling, in a blinking of an eye, you are so poor that even the house you are living in is a shell. No windows. No floor. No ceiling!! I hope she writes a memoir or autobiography because I will buy it in a heartbeat.

That fall from grace informed her financial journey. She promised herself never to let what happened to her dad to be her story. And today, she has achieved her financial independence and serves to educate the masses about financial freedom.

Here are some nuggets that stood out for me and I will be practising them all as the years go by:

Delay pleasure. In a world where social media and advertising are causing discontent, this is a hard task. We want to enjoy life. We are not here to suffer and this philosophy will see us borrowing money, buying clothes, the latest iPhone, visiting each new restaurant, etc to keep up to date with the trends. We were reminded that if we do not have those things, we will not die. Hahaha!!

Why buy the latest everything but have no food for tomorrow? Struggle through the month?

Are you able to delay pleasure to build a financially stable future? We were admonished to think long-term. As you think further on this topic, ask yourself these questions: What is your lifestyle like? Do you attend every concert in town; every bridal and baby shower; wedding meeting? How do you spend your money?

Save. Save. Save. This song has been sung since time immemorial. But how many of us practise it? How much have you been saving since the year began? It’s not about the amount but the habit. The goal is to increase your income flow as the years go by.

Invest. There is no one way to make wealth. But save to invest and put your money in places or things that give you a cash flow. Read up on investment schemes, seek understanding and then make the big decision. Don’t invest because your friend says it’s good.

Do not scatter your investments. Start small and allow yourself to grow. I know many motivational speakers advise us to have many streams of income. But if you are starting, focus on one place. Creating wealth is gradual. This right here released me from the bondage of having seven streams of income.

Think about money for at least an hour a day. Grace says she started with an hour and has increased it to more. This time allows you to think about wealth creation, opportunities, what you are spending on and what you can cut, etc. Listen to podcasts on money. Read books about money. This benefits you. It gives you focus.

Self-awareness. Do you know your money habits? Are you an impulsive buyer? When do you overspend? Which friends make you spend? What moods make you spend? What money habits are letting you down? Growing financially aware is my new goal this season.

Die to people’s opinions. Grace reminded us of how many people like to appear rich yet they are poor and heavy in debt. As you make changes in your life, things shift and people will talk. But in her signature humour style,” do you lose a kidney? Do you lose your toes? Is everything functioning fine?” People are born to run their mouths and the decisions you make for your future self will be discussed. But that should not stop you from living life in your lane. Learn to impress yourself alone. People are too dissatisfied to accept anyone.

Lastly develop two habits and practices: intentionality and patience. Be intentional about the life you want and work towards it. Be patient. “Haste leads to poverty.” Do not think you have to own everything right now. They will come along the way. Get financially stable and independent and then watch how life gets easier.

Read all about GROW program here.

Photos Courtesy: Nze Eve Photography

I’m excited for you and what you are learning. Cheers to growing in all aspects of life. 🥂

Thank you my dear friend. You would have loved Grace Makoko`s session.